Hsa Account Dental Expenses . It can even be used to cover the. You can use that hsa to pay for trips to the dentist and orthodontist. You can use your health savings account (hsa) and flexible spending account (fsa) for several dental expenses,. The short answer is, yes! Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. Paying for dental expenses can be tricky, even for those with dental insurance. Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. Read on to understand your hsa and fsa. Yes, you can use your hsa to pay for dental expenses. Fortunately, a health savings account (hsa) can. The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas.

from medium.com

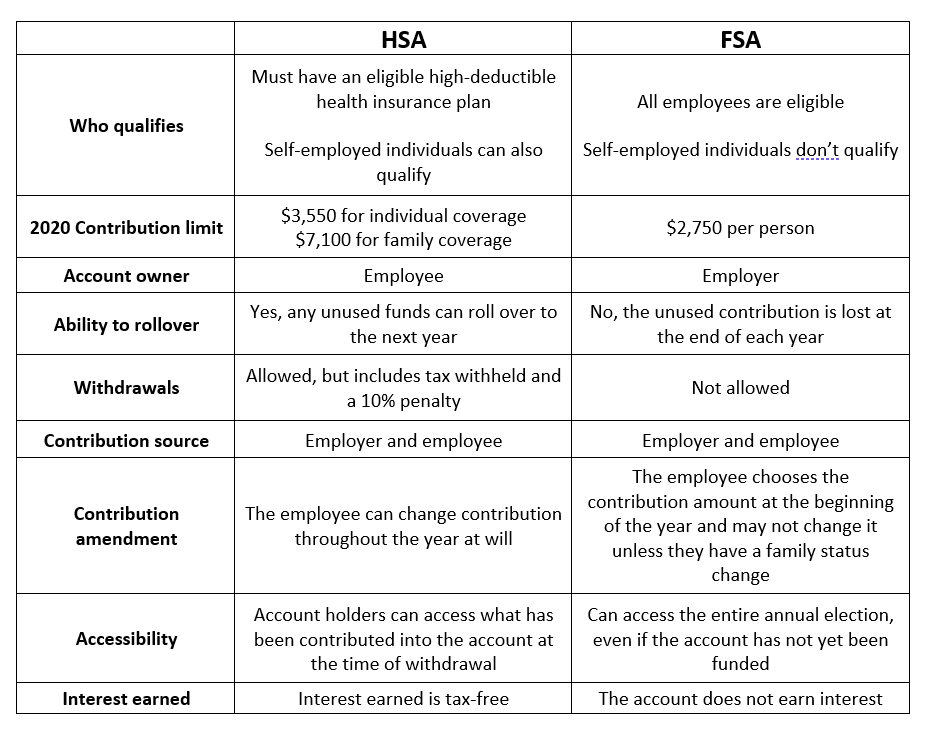

Paying for dental expenses can be tricky, even for those with dental insurance. It can even be used to cover the. You can use that hsa to pay for trips to the dentist and orthodontist. Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. Read on to understand your hsa and fsa. You can use your health savings account (hsa) and flexible spending account (fsa) for several dental expenses,. Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. Yes, you can use your hsa to pay for dental expenses. Fortunately, a health savings account (hsa) can. The short answer is, yes!

HSA accounts Optimizing returns using options in fidelity HSA accounts

Hsa Account Dental Expenses Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. Yes, you can use your hsa to pay for dental expenses. Fortunately, a health savings account (hsa) can. Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. You can use that hsa to pay for trips to the dentist and orthodontist. Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. Paying for dental expenses can be tricky, even for those with dental insurance. It can even be used to cover the. The short answer is, yes! You can use your health savings account (hsa) and flexible spending account (fsa) for several dental expenses,. Read on to understand your hsa and fsa.

From bethebudget.com

Can You Use Your HSA For Dental Expenses? Be The Budget Hsa Account Dental Expenses Yes, you can use your hsa to pay for dental expenses. The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. Read on to understand your hsa and fsa. You can use that hsa to pay for trips to the dentist and orthodontist. You can use your. Hsa Account Dental Expenses.

From westcoastgross.weebly.com

Hsa eligible expenses 2021 westcoastgross Hsa Account Dental Expenses Paying for dental expenses can be tricky, even for those with dental insurance. Fortunately, a health savings account (hsa) can. The short answer is, yes! Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. Read on to understand your hsa and fsa. Though, the expenses must qualify as “medical care”, which the. Hsa Account Dental Expenses.

From chicago.suntimes.com

HSA accounts come with more buying power than you think Chicago SunTimes Hsa Account Dental Expenses Yes, you can use your hsa to pay for dental expenses. Paying for dental expenses can be tricky, even for those with dental insurance. You can use that hsa to pay for trips to the dentist and orthodontist. Read on to understand your hsa and fsa. Fortunately, a health savings account (hsa) can. The irs has a broad list of. Hsa Account Dental Expenses.

From www.makingyourmoneymatter.com

ST301 Saving for Medical Expenses through FSAs and HSAs Hsa Account Dental Expenses Paying for dental expenses can be tricky, even for those with dental insurance. The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. Yes, you can use your hsa to pay for dental expenses. It can even be used to cover the. Yes, you can use an. Hsa Account Dental Expenses.

From thinkhealth.priorityhealth.com

What is an HSA and Will It Change Under the New Health Bill? ThinkHealth Hsa Account Dental Expenses Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. You can use your health savings account (hsa) and flexible spending account (fsa) for several dental expenses,. The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. You can use. Hsa Account Dental Expenses.

From slideplayer.com

Health Savings Accounts (HSAs) ppt download Hsa Account Dental Expenses Read on to understand your hsa and fsa. You can use that hsa to pay for trips to the dentist and orthodontist. Paying for dental expenses can be tricky, even for those with dental insurance. The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. Fortunately, a. Hsa Account Dental Expenses.

From www.slideserve.com

PPT Health Savings Accounts (HSA) Basics PowerPoint Presentation Hsa Account Dental Expenses Yes, you can use your hsa to pay for dental expenses. Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. Paying for dental expenses can be tricky, even for. Hsa Account Dental Expenses.

From www.patriotsoftware.com

What Is an HSA? Rules and Benefits of an HSA Hsa Account Dental Expenses It can even be used to cover the. The short answer is, yes! Yes, you can use your hsa to pay for dental expenses. Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. The irs. Hsa Account Dental Expenses.

From db-excel.com

Hsa Expense Tracking Spreadsheet — Hsa Account Dental Expenses Read on to understand your hsa and fsa. Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. You can use that hsa to pay for trips to the dentist and orthodontist. Paying for dental expenses can be tricky, even for those with dental insurance. Yes, you can use an hsa (health savings. Hsa Account Dental Expenses.

From grantsmith.com

Health Savings Accounts (HSA) Grant Smith Health Insurance Agency Hsa Account Dental Expenses Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. Read on to understand your hsa and fsa. The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. You can use that hsa to pay for trips to the dentist. Hsa Account Dental Expenses.

From blog.healthequity.com

Can I use my HSA or FSA to pay for dental services? Hsa Account Dental Expenses The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. Read on to understand your hsa and fsa. Fortunately, a health savings account (hsa) can. You can use that hsa. Hsa Account Dental Expenses.

From balthazarkorab.com

Can You Use Your HSA for Dental Expenses Expert Guide Hsa Account Dental Expenses The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. Fortunately, a health. Hsa Account Dental Expenses.

From health.gov.capital

Can HSAs and FSAs be used to cover dental and vision expenses? Health Hsa Account Dental Expenses Read on to understand your hsa and fsa. The short answer is, yes! Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. You can use your health savings account (hsa) and flexible spending account (fsa) for several dental expenses,. Though, the expenses must qualify as “medical care”, which the irs defines as. Hsa Account Dental Expenses.

From slideplayer.com

Tips to maximize your HSA savings ppt download Hsa Account Dental Expenses You can use that hsa to pay for trips to the dentist and orthodontist. Yes, you can use your hsa to pay for dental expenses. Read on to understand your hsa and fsa. The irs has a broad list of expenses related to medical, dental, and vision care that it considers as qualified expenses for hsas. It can even be. Hsa Account Dental Expenses.

From fabalabse.com

Can I use HSA for dental? Leia aqui Can I use my HSA at the dentist Hsa Account Dental Expenses It can even be used to cover the. Yes, you can use an hsa (health savings account) or fsa (flexible spending account) for dental expenses. You can use your health savings account (hsa) and flexible spending account (fsa) for several dental expenses,. Yes, you can use your hsa to pay for dental expenses. The irs has a broad list of. Hsa Account Dental Expenses.

From www.accuplan.net

How Does An HSA Work? Accuplan Benefits Services Hsa Account Dental Expenses Paying for dental expenses can be tricky, even for those with dental insurance. Read on to understand your hsa and fsa. It can even be used to cover the. You can use that hsa to pay for trips to the dentist and orthodontist. Yes, you can use your hsa to pay for dental expenses. The irs has a broad list. Hsa Account Dental Expenses.

From studylib.net

Health Savings Account (HSA) Eligible Expenses Hsa Account Dental Expenses Paying for dental expenses can be tricky, even for those with dental insurance. Yes, you can use your hsa to pay for dental expenses. Fortunately, a health savings account (hsa) can. Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. Read on to understand your hsa and fsa. The short answer is,. Hsa Account Dental Expenses.

From healthyell.com

Can HSA Be Used For Dental Expenses To Save Money? Hsa Account Dental Expenses You can use that hsa to pay for trips to the dentist and orthodontist. Though, the expenses must qualify as “medical care”, which the irs defines as the, “diagnosis, cure, mitigation,. Yes, you can use your hsa to pay for dental expenses. Paying for dental expenses can be tricky, even for those with dental insurance. You can use your health. Hsa Account Dental Expenses.